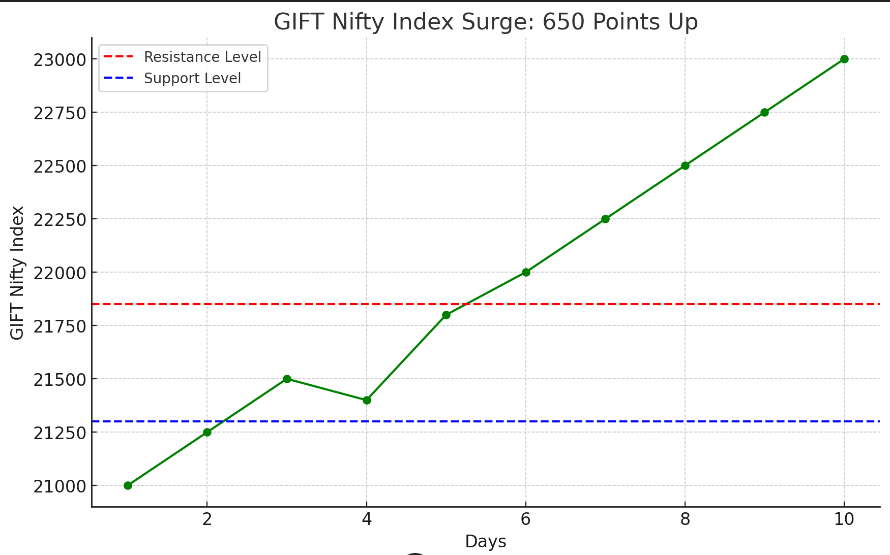

The Indian stock market is abuzz with the significant surge in GIFT Nifty, which has jumped 650 points. This dramatic increase is set to influence trading dynamics in today’s session. Here’s a detailed analysis of the current market scenario and what traders should anticipate.

GIFT Nifty’s Impact

GIFT Nifty, a key indicator of market sentiment, has risen sharply by 650 points, signaling a bullish start to the trading day. This rise is seen as a positive sign for the broader market, hinting at increased investor confidence and potential upward momentum in the short term (Business Today) (5paisa).

Market Sentiment and Key Indicators

US Market Influence: The recent performance of the US markets has played a crucial role in shaping today’s outlook. US stocks ended on a mixed note, with technology stocks showing resilience despite broader market fluctuations. The Federal Reserve’s recent comments on maintaining interest rates have also provided a degree of stability, which is reflecting positively on global markets including India (Business Today).

Asian Markets: Most Asian markets were shut due to New Year celebrations, resulting in lower trading volumes. However, the overall sentiment remains cautiously optimistic. Investors are keeping a close watch on economic indicators from major Asian economies, which are expected to influence trading patterns in the coming days (5paisa).

Technical Analysis and Trading Strategies

Nifty Outlook: Technical analysts suggest a cautious approach. The immediate support levels for Nifty are pegged at 21,600 and 21,500, with strong support around the 21,300 mark. On the resistance front, 21,850 followed by 22,000 are seen as significant hurdles. Given the current overbought conditions, a strategy of booking profits at higher levels while being ready to buy on dips is recommended (Business Today).

Nifty Bank: The banking sector index, Nifty Bank, has shown some bearish tendencies, with resistance at 48,300. Analysts suggest that staying below this level could keep the trend bearish, potentially pushing the index towards 47,500. Conversely, a decisive move above 48,300 could drive the index towards 49,000 (Business Today).

Broader Market Trends

Volatility Index (India VIX): The India VIX, which measures market volatility, has seen a slight increase, indicating a rise in market uncertainty. This uptick suggests that while the overall market sentiment is positive, there are underlying concerns that could lead to short-term fluctuations (5paisa).

Foreign Portfolio Investments (FPI): FPIs have been net buyers, pumping significant capital into Indian equities. This influx is a strong indicator of confidence in the Indian market, supporting the bullish outlook. However, domestic institutional investors have been selling, which adds a layer of complexity to the market dynamics (5paisa).

Sectoral Insights: Analysts recommend a stock-specific approach, particularly focusing on sectors that have shown resilience. Technology and banking stocks are expected to remain in focus due to their recent performance and ongoing developments in their respective industries (5paisa).

Conclusion

Today’s trading session is poised to be dynamic, driven by the significant rise in GIFT Nifty and various global and domestic factors. Traders are advised to adopt a balanced approach, leveraging technical support and resistance levels while staying abreast of broader market trends and economic indicators. This cautious optimism could help navigate the potential volatility and capitalize on emerging opportunities in the market.